#9 – Mental Health Check-in

I wasn’t sure whether to write about this. Its self-indulgent, but maybe someone can empathise with this, or at least parts of it.

I kind of hoped that my finding FIRE as a concept would really help me get some focus and drive to be free and happy. Its definitely given me something to aim for and a new perspective on saving and a far improved financial intellect, but I think I’m becoming too conscious of it.

I feel like its taken over from all of my other interests and my spare time I’m now desperately trying to find a new book or blog to satisfy the thirst for knowledge. I can’t find much that is new and so I’m checking my investments more on an hour-by-hour basis. Maybe its my job that is not keeping me occupied enough? Either way, I’m tracking my net worth almost hourly and I don’t think that is healthy.

The bedrock of mine and Mrs FFF’s plan is to work hard for 5 years in our well paid jobs, get the work done we need to do on our house and set a foundation from which one or both of us can downgrade our jobs in the knowledge that we’re well on the way to financial freedom. My wife is really struggling with her job and her own mental health issues and so I’m selfishly concerned that she will have to leave and it will upset our plans.

Before all this, I would be telling her to quit if she hates it and not worrying too much about it as we have one good wage and we can cover our bills and living costs on that quite easily. I’m still saying that to her now but I can’t help resenting it too now and its definitely having an impact on my psyche because it means I will have to work longer. Work in a job that I’m feeling very ineffectual at and is not fulfilling. Work that I cannot see me doing for the rest of my career if its going to be 20 years, not 5-10 years as I’d been planning.

If I had known this would be happening with mine and my wife’s jobs, we should never have bought this house and gotten a larger mortgage. Don’t get me wrong, we’re lucky that we can always sell and downsize and have a much smaller mortgage if we wanted to, but we have had a taste of this house now and so it would be horrific (and costly) to have to move again.

I should also mention that we (or more accurately my wife) are having IVF treatment right now. Our first child was IVF and this is now our 2nd attempt post our son being born and this is expensive as we’re on our 5th go in total. My wife is convinced that her work is affecting her health and the chances of success.

I guess the only road forward is to take one day at a time at the moment, re-evaluate in 1 month, 3 months, 6 months. If anyone has any advice or experience with all/some of this, then I would be glad to hear your thoughts.

#8 – The Million Pound Question 2 – Reprise

Yesterday marked my return to blogging after a 2 month hiatus and I posed the question about what would you do with a tax free £1m if you received it right now. Read it here

I woke up this morning at 5 thinking about many things, checking my emails and all the things you really shouldn’t do if you want any chance of going back to sleep.

My mind wandered back to this and I realised my gut feel didn’t take into account a few important factors. Namely these:

- We might have a 2nd child – quite an important oversight but this is on the horizon hopefully within the next few years. Whilst i don’t believe they cost as much as everyone says (assuming you don’t private school them and they don’t go to university), they will need to be factored in. This leads me onto…

- I had forgotten my son’s Junior ISA. Currently we pay in £100 a month to give him a good start once he’s 18. I would strongly encourage him to not touch that when he’s 18 and strive for financial independence with my guidance and let compound interest work its magic. Anyway, i digress, I would boost this to the maximum £4,260 per annum. Some quick calculations (assuming 9% YoY growth) – I’m using Vanguard LifeStrategy 100% for those interested would mean (inflation adjusted) £120k at the age of 18. If he didn’t touch that (or add to it) AT ALL, when 50, he would, in theory, by financially independent. Assuming he’s employable and able to save something from 18 onwards, this should only improve drastically. Enter child number 2 hopefully, and this annual outlay is doubled to £8.5k.

- My wife would never, ever, let me get away without spending money on the house. We’ve bought something structurally pretty good but it could use £70-80k to get it configured better for us and updated. We think the work would add value but not a huge amount, but justifiable.

- The other adjustment i would make to my original plan is to pay off the mortgage entirely. Getting the outgoings down takes far more pressure off and whilst probably not the best way to maximise the money, it represents a spread of risk away from solely investment strategies and any potential headwinds in the near future (ie. Brexit etc)

- Now, i need some help, the big outstanding question i have is not what to invest in with the remainder, but when to invest it. Do I do as i said yesterday and add my max ISA allowance each year and drip feed and in theory sacrifice growth over time, but have no tax considerations, or do you invest it all in one go, maxing out the ISA allowances but then investing in general fund and share accounts for the rest. This means clearly if i drawdown and make profits above my allowances i will have to pay tax.

My question this: What is the best strategy? If i took option 2 (invest all at once, not all in a tax wrapper), can i transfer 40k each year into the ISA account? Would this be possible, even?

Then there is my SIPP – should i drip some into that every year (max £40k) instead to get around the tax? Obviously i then cannot touch it for 17 years until im 57 (at the moment anyway) and then cannot get access to all of it without a tax penalty…

HELP ME!

#7 – The Million Pound Question

I haven’t written here for a while. I think I slipped into depression after my portfolio plummeted in October, all the while reading many reports that the markets are dying, and we should all get out – its overvalued in the US and thats where i have 40% of my investments blahblahblah

That, and we moved house and have to spend a small fortune on furniture etc, so i’ve not been investing anything so have had no updates!!

I’ve had to reach into the depths of resolve to stick with it all and not change my approach. I’ve bought books on crypto, p2p property investing and even revisited investing in Gold.

My reading has also taken me back to blogs and specifically the UK FIRE scene to get some perspective. One post I enjoyed was the theoretical question of what would you do if you won a tax-free 1 million pounds right now. The idea being you don’t think too much about it, its the gut feel response in that moment. So here goes…

- Quit work. Surely I can, actually, its not just me, its my wife too. Or can I? My target number for our financial freedom is 900k, worked out with drawdown of 3-4%. OK, so that was worked out from the age of 55, not 39, so maybe i need to be a little more towards the 3%. We currently have c.33k in stocks and shares ISAs, and 90k in SIPPs/Pensions. We have 360k equity on our house and a 335k mortgage. What next? Hmmm… tempting to pay off the mortgage, but we would get 5% early repayment charge as we’re in the first year of a 5 year fixed term, so 16.75k. Is that better than overpaying mortgage by the maximum amount (10%) every year and in theory getting % growth from passive investing?

- Let’s go with overpaying mortgage by maximum each year (10%) and so keeping investable pot as high as possible. So we’re down to 966k, with essential monthly outgoings remaining the same at about 4k (including mortgage and my son’s nursery cost and fun money). Thats 48k per year required.

- Investing: Investing it all at once means tax and lots of it outside of the 20k personal ISA allowance. Lets assume we invest 40k per year (allowance x 2) . Add that to the savings we have already, if i assume 9% growth (optimistic right now), its not that much (10-15k), and certainly with 48k coming out that will make a serious dent in the overall number until we have enough invested to cover it.

What to invest in? It would have to be less risky than by 100% equity ratio as I am now in my aggressive wealth building mode. Maybe i would go for a Vanguard LifeStrategy 60% or 40%. Maybe i wouldnt want to be so passive, but i probably should be. Do i trust myself?

- Outgoings in 5 years time – 966k minus 5 x 25k (mortgage overpayments) – 125k, minus 5 x 48k outgoings = 240k, minus pay off mortgage in full, say 160k at this point = 440k of original 1m leftover.

OK, mortgage paid off and child not in nursery anymore, and no plans for private education currently, where does that leave us in terms of monthly outgoings. Probably about 1.8k x 12 = 21.6k per year required. By then, we’ll have 200k plus 120k in investments/pensions plus 440k = 720k total assets, assuming zero growth in 5 years. We would of course have at least 540k in equity in the house too (assuming no change in house value), so net worth is 1.26m. Thats enough, surely?

- What next, keep investing 40k per year in ISAs whilst dipping into savings for living costs? It would take 11 years to invest it all that way, and assumes the ISA allowance remains the same. Maybe it would actually be best to have invested it all in one go at the start to benefit from the growth, and not worried too much about it being out of the ISA wrapper? Arrrgh, i dont know enough about it!!

Hmmm…. I’m now wondering if i should’ve quit work. This is depressing….it shouldn’t be, but it is.

What would you do?

#6 REVIEW – Aldi

Once again I’m living by the teachings of RESET by David Sawyer in a bid to optimise our savings. Last weekend we took on Aldi and here is my brief summary of what you can expect:

- A very poor experience if you take your 1-year-old and no pound coin for the trollies. We had to carry the considerable lump around with us whilst trying to do our big shop using just two baskets, somewhat tainting the whole experience

- A very full car park.

- It will be very busy on a Saturday lunchtime. Footfall was bonkers and a little annoying in some key areas as it takes a while to get anywhere

- Good quality food for less – I can safely say that after eating the wares this week, I have yet to die.

- You will probably leave without everything on your list – it was busy, the staff were good at topping up but just cannot keep up with the demand. They will not have the items you would typically find in a superstore of course.

- No pitta bread – I mean seriously. See previous posts about the importance of this.

- Rapid cashiers – I couldn’t keep up with the pace and with very little space to put the swiped goods so my bagging was not optimal. nb. I squashed the bread much to the annoyance of Mrs M.

- It’s better than Lidl. It just seemed more organised in my opinion, but that might be a reflection of our local stores and staff

Once my wife and I recovered from our tense experience (where I took the blame re. the trolley as I should clearly have done my research into this beforehand 🙂 ) and after taking stock, my wife summarised its definitely cheaper and we’ve saved money – annoying we cannot tell by how much since we lost the receipt. She is not sure if the brands are as healthy as the major chains (I suspect they are the same) but is willing to go again.

I think that is a result. Next time, we’ll go earlier… with a pound coin.

#5 Siriusly (sic) Learning to Hold my Nerve

I told you I was changing my investment strategy based on the learnings of David Sawyers RESET book. That selling off of all my existing investments and re-investments is now complete. Well….nearly.

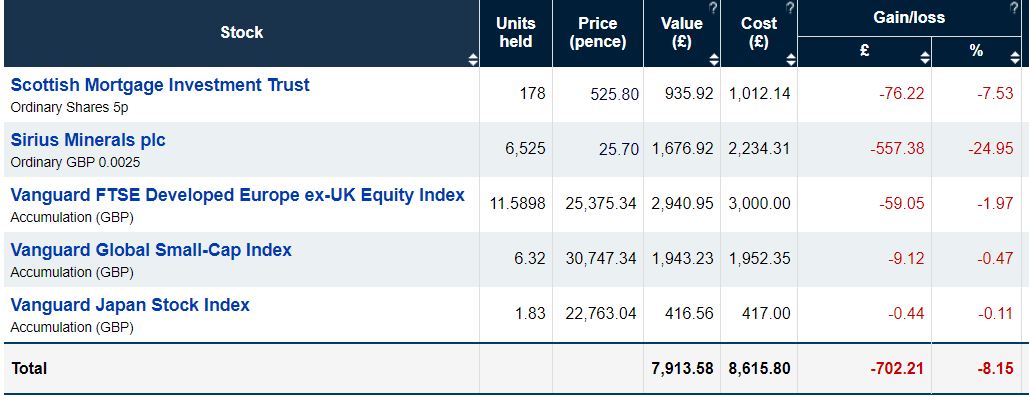

I need to hold my hand up and say that I still have two shares in my portfolio that were recommended to me. They represent just under 10% of my total portfolio, and I will be getting rid of them at the earliest opportunity but I wanted to give them some time to get back to at least parity as both were slightly in the red (both roughly minus 2-3%). First being Scottish Mortgage Investment Trust (ok, not strictly a share) and the second Sirius Materials.

This is the picture as of this morning.

Note the funds are all down, but that doesn’t concern me since the markets have tanked everywhere over the last few days. But fudge me, Sirius has really taken a hit. The reason for the severe drop is due to the embarrassing revelation that they had seriously under-costed two major construction projects. The question is: DO I THROW MORE MONEY AT IT NOW?

What would you do?

#4 Leaner, Meaner Saving Machiner

Would you just look at this gorgeous chart (screenshot from Money Dashboard).

My wife and I have been trying to address our spending for the last month. Every single self-help book on Financial Freedom covers this as being a major element to work on so we (well….I) took the plunge into dissecting it. I ran a full assessment of all expenditure for every single purchase on both our current accounts and joint account, and was frankly shocked at how much we were spending on completely unnecessary items. In particular, top up shops from supermarkets, but also takeaways because we couldn’t be bothered to cook, or we just hadn’t been organised enough to have any food in the fridge.

Since this discovery, we are planning our meals well in advance of the “big shop” at Morrisons every Sunday morning. We are noting down all items that are running low so we don’t forget. We plan meals around what we have in the cupboards, but also how easy recipes are to cook and with as little cooking utensils as possible. This may sound over the top, but remember, we are horrifically lazy and busy with a 1-year-old, so this works for us. Hot tip: One pot and slow cooking recipes are now king in our household!

Groceries is covered under the “Home” umbrella and you can see the difference this has made already from July to August. Bearing in mind we haven’t even attempted Lidl/Aldi as per David Sawyers advice from his RESET book, so we think we can do even better.

You’ll see a bigger change in Enjoyment, and the cynics among you will probably say that August wasn’t as much fun. I honestly didn’t notice if it was. The change here came about because my wife and I trialed giving ourselves an individual “fun” allowance of 300 quid (broadly 10% of our combined income) and piled all excess cash (after regular outgoings) into savings (rainy day fund/items for our new house), and investments in my Shares and Stocks ISA with Hargreaves Lansdown.

In fairness, I probably did go out less, but just having this in your mind when spending your allowance makes you assess what you really want vs what you need. I was sceptical my wife could do this since she is not a natural with money. Her coffee/fruit shakes spend was obscene, but even she was amazed at the difference it made. She even told me she was proud of me for making so much effort on all this, which I don’t think has ever been said in the last 10 years.

Have any of you undertaken this challenge? How much have you saved? I’m intrigued…

PS. the eagle-eyed amongst you are probably thinking what on earth did you do with your family in August. Answer: sod all, we moved our nursery direct debit forward on request from the nursery so it double counted, so there!

#3 Book Review: RESET – How to Restart Your Life and Get F.U. Money by David Sawyer

The Unconventional Early Retirement Plan for Midlife Careerists Who Want to Be Happy Kindle Edition. £2.95. Buy on Amazon

Reading is my new thing. I chanced upon Ann Wilson – The Wealth Chef and whilst I couldn’t get on with her writing style AT ALL (there are only so many references to food one can take), I do credit her with the initial inspiration for my newfound obsession with my financial future.

I’ve started many books on many different but related subjects since, but the first I’ve truly finished (without skipping boring bits) was this one. It’s very new (it was published 29th August 2018) which had instant appeal to me, but also its UK focussed. The world is awash with US authors/bloggers on this subject but its refreshing that he ignores this and talks to me and not the mass market. Not only is his writing style engaging but I was more surprised that this is not just a book about money and growing it to be financially free, but a guidebook to life.

OK, that sounds dramatic, but it really struck a chord with me. Whilst we do not share the same career, his story is remarkably similar.

I don’t actually just want money, I want to be happy, I want to find meaning in life, I want to stop being so lazy, I want to not have to worry about my job, I want more in a nutshell.

Sections on Happiness, Purpose, Finding Your Why are not new in this genre, but I hadn’t seen anyone touch on Future-Proofing your career by learning about digital (applies to any career) or De-cluttering (your mind….and house obviously). I particularly liked that he has walked the walk and fed back on the benefits of each of these on his and his family’s life outside of the obvious benefits. It was inspiring.

Perhaps the measure of any of these sorts of books is what have I actually done as a result of reading it. So here is my list:

- Signed up to Money Dashboard and linked my and my wife cash accounts – I can now see exactly what we have in one place. Its revolutionary for me. HIGHLY RECOMMEND

- Ordered Marie Kondo – The Life-Changing Magic of Tidying (my next book)

- Planning to go shopping in Lidl and Aldi rather than Morrisons to shave £100’s from monthly grocery shop – If they can do wholemeal pitta bread on par with Morrisons, I’m converted.

- In the process of consolidating my old pensions into a SIPP – I had previously tried to optimise the investment selections but realised they are not diversified correctly and I want to control the 3 of them under one plan.

- Sold my entire fund portfolio – OH YEAH, quite a big one. I had previously tried to emulate suggestions from Andrew Craig’s How to Own the World, but I got sidetracked by Trustnet’s fund recommendations and didn’t split them globally correctly. I figured lets just start again and stick to a tried and tested plan suggested in this book

- Sold all my sons shares in his Junior ISA so to reinvest properly – as per 5

The Investing section is clearly the big one and his practical advice on exactly what funds to invest in and in what exact proportion is precisely what I’ve not seen anywhere else. I just want to copy someone and not let my amateurism get in my way.

I trust him because he reads a helluva lot. The references throughout are vast and varied. From financial heavyweights to blogging heavyweights and I can see a healthy mix of independent thought on each topic. It just feels like he takes the best bits.

I really hope I do not read any other books that contradict all this as I cannot be bothered to keep selling my funds and restarting every week, and I really don’t think I will read anything on this subject for a while now because I feel I have a guidebook I will refer back to time and time again. Better to focus on other things like Affiliate Marketing for this blog, investing in business, Marie Kondo’s book. I mean seriously, if I read that, my wife will think I’ve gone insane. I hope she likes the new me.

#2 Me Me Me

I suppose I’d better give you a little more information about my life, my motivations, and my goals.

I’m 39 years old, married with a young son, aged 15 months. I have a good job, working in business development in market research, which enables me to work from home 100% of the time. My wife also works in the same industry, and also works from home!

My gross income is c.80-90k (dependent on commission), my wife is around the 50-55k mark. We’ve recently moved out of London after owning a 2 bed flat in SE4 for 5 years. We bought well just before a major upturn in prices in that area. We bought for 355k in 2013, and sold for 551k in February this year, netting 321k after paying off the mortgage.

This is not meant to be boastful as I am about to reveal to you a decision that is currently haunting me, and counterproductive to all the advice I’ve been reading over the last 3 weeks (ie. when I began my obsession with early retirement).

We are buying a house for 695k over a 25 year period (fixed for the first 5). It will mean using up all our savings of 390k and just leaving my investments in my Hargreaves Lansdown account of around 31k and 10k to spend on the house for fixtures and fittings. We thought we were being clever to use up as much savings as possible to keep the mortgage payments down to a minimum.

Our original plan was inadvertently the best one for my early retirement and had I become obsessed with it just 2 months earlier we would still be gunning for that, or continuing to rent. We had wanted to buy somewhere with a very low or no mortgage and do it up over time. The issue – my wife just didn’t like any of the properties. It felt like a massive backward step, and I have to say that I didn’t want to settle for a sub-par property either.

Had somebody told me that we were in effect about halfway to retirement and could be generating 20-30k a year in passive income by investing in sensible fund/shares, we would have perhaps re-evaluated.

Alas, we are too far down the line now – we have a month until we complete. The chain is short and all that stands in our way are some questionable answers to some of our questions to the vendors re. some old work that was done to the property. My wife is with me on my newfound resourcefulness and cost-saving exercises (more on those later) but doesn’t really know my feelings about the above. Am I a scaredy-cat? Should I be strong and suggest we pull out? No chance. Have you met my wife? And its a f**king nice gaff…

The point is, that I’m now focused on getting there another way. Starting again, almost, but learning how I can accelerate that as much as possible.

I’m not just motivated by money as you might think. I’m motivated by my young son and my (and my wife’s) happiness. It’s fair to say that until we left London, we had been in quite a dark place. My job was all-consuming for 6 years solid (and I mean on average 70 hours a week solid), my wife was losing patience with me and accusing me of having changed and lost myself (ie. I was always so tired, I couldn’t be assed to socialise). We had been trying for a baby for 3 years unsuccessfully, including two failed NHS IVF treatments, for unexplainable reasons (as in, they had no clue why). My wife became a bit depressed about it as you might expect.

Then suddenly, a flicker of light. We decided to have a final attempt at IVF through a private clinic. It cost us a significant chunk of money but we were fortunate to have the funds in our savings (at least one positive from my work nightmare) and after quite a grueling period of injections and blood tests (not me obviously) my wife became pregnant. Hallelujah, life is good again. Maybe this is what we needed?

The light went out. When I say the first 6 months of my son’s life were hell on earth, I’m not exaggerating. He just didn’t sleep…..like, ever. I mean I loved him dearly but there were many times we sat there wondering what the f**k had we done to deserve this. My wife became depressed, I started having to do the night shifts to try to alleviate the depression and arguments. I probably had 2 hours sleep a night for 3 months, all whilst doing my 70 hour weeks. Something had to give.

I handed my notice in at work. I’d been wanting to do it for a long time, but the birth of your child does help you re-evaluate what’s important. I also was worried about my wife and wanted to spend some time at home to help out. We forged a plan to sell up and move back to my hometown and buy a cheap house and downgrade our jobs to 20-30k a year each and live a simple life.

Obviously, that idea dissipated after a few months with no money coming in (and my wife’s maternity pay stopping). I was also very fortunate to have lined up a job with one of my old suppliers with the promise of being able to work from home (they are a US company with no UK employees) and for the same pay as I was on before but with nowhere near the level of work.

This shouldn’t have meant we deviated from the plan, but we just got a bit greedy on the house, and so here we are…

My goal – retire by 55, ideally by 50. I need to consume a lot of knowledge to get there. I’ll share what resources I have been using in the very near future.

#1 Fudge Me

So here I am, writing to myself no doubt, to begin with. Hello – o – o – o – o?

If anyone does read this, I’m Matt, and I want to share my journey to Financial Freedom with you. The difference is with this particular blog, is that I have very little idea what I’m doing. I’m Fudging it.

Why am I doing this blog?

Good question. I read a book about blogging and passive income and am now convinced this is a way to bolster my earnings and hit my objective of retirement by 55. I probably should aim higher and say 50, but I’m very nearly 40 and very easily discouraged.

I might be like a lot of you who perhaps are entrepreneurial at heart, but who lack drive and the ability to take risks. I’m a dreamer, not a doer – I have a WhatsApp group where we discuss business ideas on an almost daily basis, but when I suggest we meet up to develop the ideas, there’s always excuses or barriers getting in the way. In actual fact, most of the time we give up because, within 5 minutes of desk research, we realise our quite simply brilliant and unique idea has been done to death by others and far better than we envisaged. Sound like you?

I’m hoping that this blog will help predominantly me, of course, but I suppose it would be enriching if I could inspire others too. I’ll certainly need your expertise and guidance along the way.

The books I’m starting to read on this subject have really inspired me (I’ll review those later on), but they can never get to the specific detail of exactly how and where to invest in the here and now. I want to be totally transparent about my journey and share my innermost feelings and, importantly, results. I’ll show you exactly where my shares are at (with screenshots), if I ever make a penny from this blog (dream on), how my latest investment in Welendus – a P2P short-term loan provider (don’t tell my wife) – gets on and more. I’ll be a guinea pig. I’m fortunate enough to have a small portion of disposable income each month that I can use to trial more risky investment ideas and will report back with the results.

Please do get in touch/subscribe/whatever. If nothing else, I hope to write this with humour, whether it be with me or at me.

Thanks – anks – anks – anks

Matt

Good company in a journey makes the way seem shorter. — Izaak Walton